In the fast-evolving world of travel rewards, 2026 has already brought seismic shifts to the credit card landscape. From Southwest’s major fee restructuring to Alaska Airlines’ complete “Atmos” rebranding, the strategies for earning free flights have changed. FYI, you can earn airline miles without a card. But if you do want the best airline credit card, read the details below!

Based on the latest data and 2026 program updates, we have compiled a statistic-heavy analysis of the top airline credit cards currently on the market. Whether you are a brand loyalist or a free agent looking for flexible points, these are the cards that offer the highest return on spend this year.

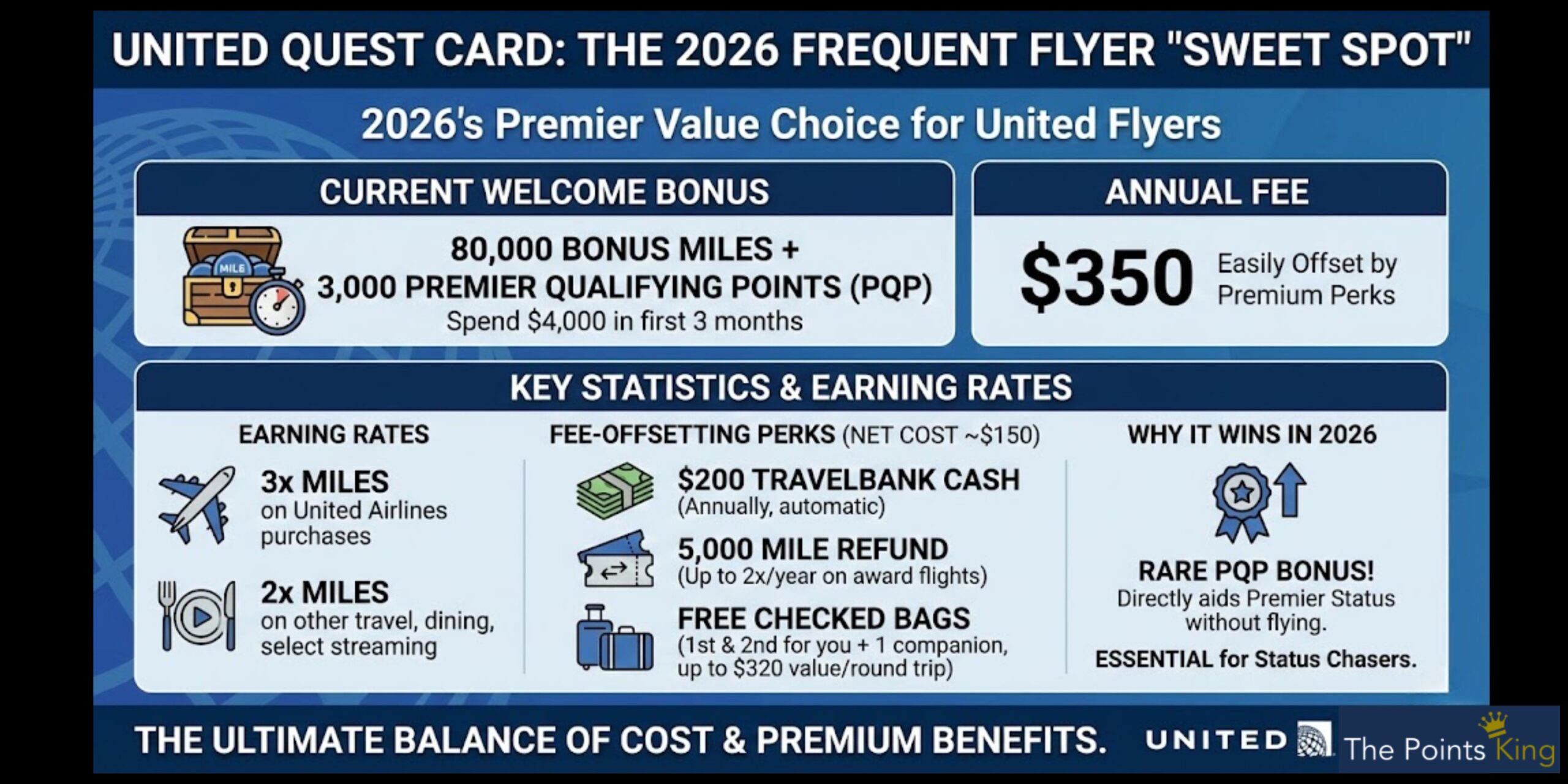

1. Best for United Flyers: United Quest℠ Card

The United Quest Card has solidified its position as the “sweet spot” in United’s portfolio for 2026, offering premium perks that easily offset its increased annual fee for frequent flyers.

-

Current Welcome Bonus: 80,000 bonus miles and 3,000 Premier Qualifying Points (PQP) after spending $4,000 on purchases in the first 3 months.

-

Annual Fee: $350

-

Key Statistics & Earning Rates:

-

3x Miles on United Airlines purchases.

-

2x Miles on all other travel, dining, and select streaming services.

-

$200 TravelBank Cash: Receive $200 in United TravelBank cash annually (automatically deposited), which effectively lowers the net cost of the card to $150.

-

5,000 Mile Refund: Get 5,000 miles back into your account after you take a United award flight (up to 2 times per anniversary year).

-

Free Checked Bags: First and second checked bags free for you and one companion (savings of up to $320 per round trip).

-

Why it Wins: The PQP bonus is a rare feature that directly helps you reach Premier status without flying, making this card essential for those chasing status in 2026.

2. Best for Southwest Loyalists: Southwest Rapid Rewards® Priority Credit Card

Southwest overhauled its card lineup in late 2025, significantly raising the annual fee on the Priority card but compensating with aggressive status-earning metrics. Note: The historical $75 annual travel credit was discontinued as of Dec 31, 2025.

-

Current Welcome Bonus: Companion Pass® valid through 2/28/2027 + 40,000 bonus points after spending $5,000 in the first 3 months.

-

Annual Fee: $229

-

Key Statistics & Earning Rates:

-

4x Points on Southwest Airlines purchases.

-

2x Points on local transit, commuting (including rideshare), internet, cable, phone services, and select streaming.

-

7,500 Anniversary Points: Automatically deposited each year (valued at approx. $105).

-

Tier Point Boost: Earn 2,500 Tier Qualifying Points (TQPs) toward A-List status for every $5,000 spent (unlimited).

-

Upgraded Boardings: 4 Upgraded Boardings per year (A1-A15 position), guaranteed.

-

Why it Wins: Despite the fee hike to $229, the inclusion of the Companion Pass in the welcome offer is a game-changer. For a couple that flies frequently, this benefit alone can save $2,000+ in airfare over the life of the pass.

3. Best for Alaska/Hawaiian Flyers: Atmos™ Rewards Ascent Visa Signature®

Following the merger of Alaska Airlines and Hawaiian Airlines, their loyalty program has been rebranded in 2026 to Atmos Rewards. The “Ascent” card replaces the traditional Visa Signature, offering massive value for West Coast travelers.

-

Current Welcome Bonus: 70,000 bonus points + a $99 Companion Fare (plus taxes from $23) after spending $3,000 in the first 90 days.

-

Annual Fee: $95

-

Key Statistics & Earning Rates:

-

3x Points on eligible Alaska and Hawaiian Airlines purchases.

-

2x Points on gas, EV charging, cable, streaming, and local transit.

-

10% Rewards Bonus: Earn a 10% bonus on all points earned if you have an eligible Bank of America account.

-

Annual Companion Fare: Earn a “Buy One, Get One for $99” fare code every year on your account anniversary (requires $6,000 annual spend prior to anniversary).

-

Why it Wins: The Atmos Rewards program remains the most valuable per-mile currency in the domestic market. The 70k offer is historically high, and the merger has opened up seamless redemption options across the Pacific.

4. Best for Delta Flyers: Delta SkyMiles® Gold American Express Card

Delta’s entry-level card remains the gold standard for casual flyers who want to avoid basic economy restrictions without paying a premium fee.

-

Current Welcome Bonus: 90,000 bonus miles after spending $3,000 in the first 6 months.

-

Annual Fee: $0 for the first year, then $150.

-

Key Statistics & Earning Rates:

-

2x Miles on Delta purchases, restaurants, and U.S. supermarkets.

-

$100 Delta Flight Credit: Earn a $100 credit after spending $10,000 in purchases in a calendar year.

-

15% Off Award Travel: Cardholders automatically get 15% off the mileage cost for any Delta award flight booked with miles.

-

Free Checked Bag: First bag free on Delta flights (saving $70 per round trip).

-

Why it Wins: The 15% award discount effectively increases the value of your existing SkyMiles by 15%. If you redeem 100,000 miles a year, the card saves you 15,000 miles—worth roughly $180—covering the annual fee on its own. Also, you can earn a bit more by selling your Delta Skymiles with The Points King – give us an email or phone call any time!

5. Best Flexible Travel Card: Capital One Venture Rewards Credit Card

If you don’t want to be tied to a single airline, the Venture card is the superior “generalist” choice for 2026, offering transfer partners that cover every major alliance.

-

Current Welcome Bonus: 75,000 bonus miles after spending $4,000 on purchases in the first 3 months. (Limited time: Plus a $250 Capital One Travel credit in your first year).

-

Annual Fee: $95

-

Key Statistics & Earning Rates:

-

2x Miles on every purchase, every day (unlimited).

-

5x Miles on hotels and rental cars booked through Capital One Travel.

-

Transfer Partners: Transfer miles 1:1 to 15+ travel loyalty programs including Air Canada Aeroplan, British Airways, and Turkish Airlines.

-

Global Entry/TSA PreCheck: Up to $120 credit every 4 years.

-

Why it Wins: The simplicity of “2x on everything” combined with powerful transfer partners makes this the ultimate catch-all card. The current addition of the $250 travel credit for new applicants effectively pays you $155 to hold the card for the first year.

6. Best for American Airlines: Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

American Airlines remains the only major U.S. carrier with a published award chart (via partner awards), making their miles extremely valuable for international business class.

-

Current Welcome Bonus: 80,000 American Airlines AAdvantage® miles after spending $3,500 in the first 4 months.

-

Annual Fee: $99 (Waived for the first year).

-

Key Statistics & Earning Rates:

-

2x Miles on eligible American Airlines purchases, restaurants, and gas stations.

-

1 Loyalty Point per 1 eligible mile earned (counts toward status).

-

$125 Flight Discount: Earn a $125 American Airlines flight discount coupon after spending $20,000 in a membership year.

-

Preferred Boarding: Group 5 boarding on American Airlines flights.

-

Why it Wins: The waiver of the first-year annual fee makes this a risk-free option to test. The 80,000 mile bonus is enough for a round-trip ticket to Europe or flight to Japan in economy, offering exceptional ROI for a card that costs $0 upfront.

Summary Table: 2026 Top Picks for Airline Credit Cards:

| Card Name | Annual Fee | Welcome Bonus | Best Feature |

| United Quest | $350 | 80k Miles + 3k PQP | $200 TravelBank Cash |

| Southwest Priority | $229 | Companion Pass + 40k | 4x Pts on Southwest |

| Atmos Ascent (Alaska) | $95 | 70k Points + BOGO Fare | 10% Relationship Bonus |

| Delta Gold Amex | $0 ($150) | 90k Miles | 15% Award Discount |

| Capital One Venture | $95 | 75k Miles + $250 Credit | 2x Miles Everywhere |

Disclaimer: Information is current as of February 2026. Credit card offers and benefits are subject to change by issuers at any time. Please verify specific terms and conditions on the issuer’s website before applying.

Frequently Asked Questions (FAQ): Top Airline Credit Cards of 2026

Below are detailed answers to the most common questions regarding the top airline credit cards for 2026. We’ve crunched the real-life numbers to help you decide which card belongs in your wallet this year.

1. Is the United Quest℠ Card really worth the $350 annual fee?

A: Yes, for anyone who flies United at least twice a year, the math suggests the card pays for itself. While $350 sounds steep compared to the old $250 fee, the guaranteed perks offset nearly the entire cost before you even factor in the welcome bonus.

Real-Life Math:

-

Annual Fee: -$350

-

TravelBank Cash: +$200 (This is automatic credit you can use to book flights).

-

Award Flight Refund: +$150 (approx. value). You get 5,000 miles back per award flight (up to 2x/year). If you redeem miles for two flights, getting 10,000 miles back is worth roughly $150 at a valuation of 1.5 cents per mile.

-

Net Cost: $0 (effectively free).

Conclusion: If you use the $200 credit and redeem miles twice, you effectively hold the card for free, while gaining free checked bags ($320 value per roundtrip for 2 people) and earning 3x miles on United purchases.

-

Official Page: United Quest℠ Card

2. I heard Southwest removed the $75 travel credit from the Priority Card. Is it still a good deal?

A: It is true that the $75 travel credit was discontinued in late 2025, and the annual fee is now $229. However, for 2026, the value has shifted to the Welcome Bonus and the Anniversary Points.

Real-Life Math:

-

Annual Fee: -$229

-

7,500 Anniversary Points: +$105 (Southwest points are fixed at approx. 1.4 cents each).

-

4 Upgraded Boardings: +$120 (Valued at $30-$50 each; essential for getting better seats without the stress).

-

Net Cost: $4 (effectively).

The “Hidden” Value: The current offer includes the Companion Pass® valid through Feb 2027. If you take just two round-trip flights with a partner costing $400 each, you save $800 instantly. That massive savings dwarfs the fee increase.

-

Official Page: Southwest Rapid Rewards® Priority Credit Card

3. What is “Atmos Rewards,” and does the old Alaska Airlines Visa still work?

A: Atmos™ Rewards is the new loyalty program name for the combined Alaska Airlines and Hawaiian Airlines entity, officially launched in January 2026. If you have an old Alaska Airlines Visa Signature, it is now the Atmos™ Rewards Ascent Visa Signature®. Your old card works, but new applicants will receive the new “Ascent” branding.

Why the “Ascent” Card is different: It now earns 3x points on both Alaska and Hawaiian flights. The most critical number here is the Companion Fare.

-

Scenario: You want to fly to Maui during peak summer. Tickets are $800 each.

-

Without Card: You pay $1,600 for two people.

-

With Companion Fare: You pay $800 for yourself + $99 (plus ~$23 tax) for your partner. Total: $922.

-

Savings: $678 on a single trip, easily justifying the $95 annual fee.

-

Official Page: Atmos™ Rewards Ascent Visa Signature®

4. Does the Delta SkyMiles Gold Amex get me into the Delta Sky Club?

A: No. This is the most common misconception. The Delta SkyMiles Gold American Express Card is purely for earning miles and saving on checked bags. It does not provide lounge access.

Who is it for? It is for the casual traveler who wants to save money.

-

Bag Fee Savings: A family of 4 checking bags on one round trip pays $280 in fees ($35 x 4 people x 2 ways).

-

With Card: You pay $0.

-

Result: One family vacation covers the $150 annual fee (after the first free year) nearly twice over.

-

Official Page: Delta SkyMiles® Gold American Express Card

5. Why should I get the Capital One Venture if I mostly fly American Airlines?

A: Surprisingly, the Capital One Venture Rewards Credit Card can be better for American Airlines flyers than AA’s own cards because of “transfer partners.”

While you cannot transfer Capital One miles directly to American Airlines, you can transfer them to British Airways Avios to book American Airlines flights.

Real-Life Example:

-

Flight: A short-haul American Airlines flight from Miami to Nassau.

-

Price on AA.com: 15,000 AA miles (dynamic pricing).

-

Price via British Airways: Often only 9,000 Avios (distance-based chart).

-

Strategy: You transfer 9,000 Capital One miles to British Airways and book the exact same AA flight, saving 6,000 miles.

Plus, the current offer includes a $250 Capital One Travel credit in the first year, which wipes out the $95 annual fee for nearly three years.

-

Official Page: Capital One Venture Rewards Credit Card

6. Is the Citi / AAdvantage Platinum Select offer of 80,000 miles good?

A: Yes, historically, the standard offer hovers around 50,000 to 60,000 miles. The current 80,000-mile offer is a “high-water mark” for this card.

What is 80k miles worth?

-

Domestic: Roughly 3 to 4 round-trip economy tickets within the U.S.

-

International: One round-trip ticket to Europe in Economy (often ~60k miles) plus leftovers for a domestic trip.

-

Value: At a conservative 1.5 cents/mile, this bonus is worth $1,200 in travel. Since the annual fee is $0 for the first year (then $99), this is pure profit for new cardholders.

-

Official Page: Citi® / AAdvantage® Platinum Select® World Elite Mastercard®