The process for selling points in 2026 is straightforward with The Points King:

| Program | Estimated Cash/“Sell” Value | Notes |

|---|---|---|

| Amex Membership Rewards | ~$0.008 – $0.03 per point | Flexible transferable points are among the most valuable; third-party brokers sometimes pay roughly 1–3¢/point in cash offers (varies by volume and demand). |

| Chase Ultimate Rewards | ~$0.01 – $0.02+ per point | Ultimate Rewards can be worth ~1.8–2.2¢ when redeemed smartly; sell value on secondary market tends lower, closer to 1–1.8¢/pt. |

| Capital One Miles | ~$0.01 – $0.018 per mile | Often ~1.7¢ in value on travel, resale typically closer to 1¢+. |

| Citi ThankYou Points | ~$0.01 – $0.02 per point | Transferable to partners; resale likely closer to ~1¢. |

| Bank of America Reward Points | ~$0.01 per point | Cash redemption is flat ~1¢; resale potential limited. |

| Bilt Rewards Points | ~$0.012 – $0.02 per point | Often valued ~1.6–2.1¢ in travel redemption; resale typically lower. |

The reason for selling credit card points is simply because most credit card rewards programs do not offer cash redemption processes. Many credit card owners accrue millions of points but end up losing much of the value due to points expiring or being exchanged for a gift card which they don’t need. (You can however convert your points to airline miles).

The Points King is currently dealing with 10-12 credit card company points, and will buy points if you are looking to sell your extra points, and can accommodate the following transactions:

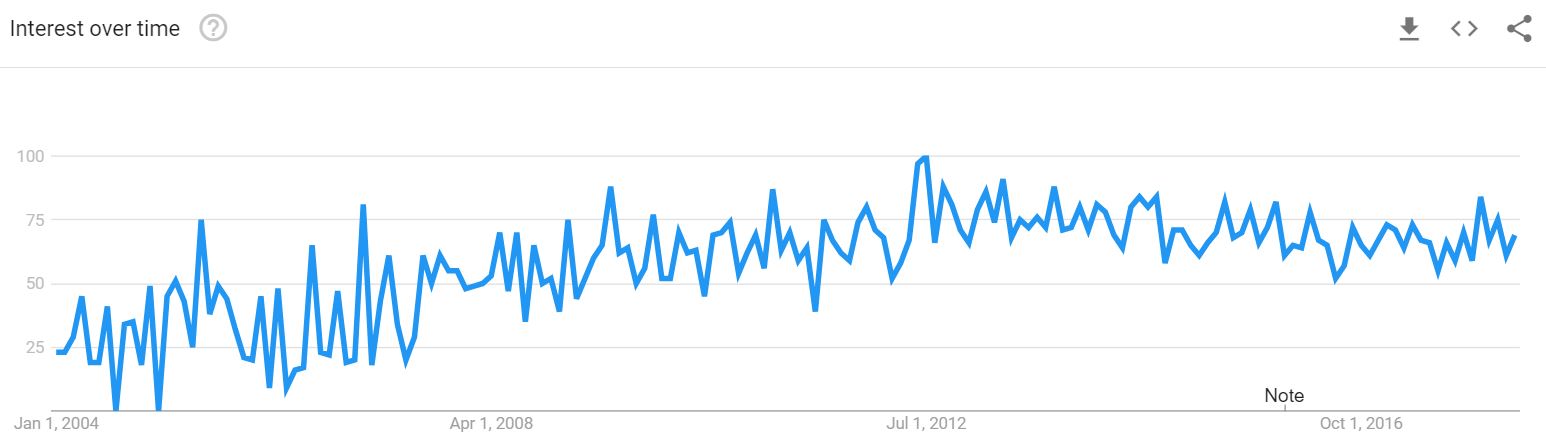

Believe it or not, credit card owners have been selling their points via online brokers since 2004, with the most popular credit card points program being Amex – selling Amex points is easily the most processed point transaction that we have seen for years.

Check out this chart from Google Trends which shows historical interest in ‘sell points’ since 2004 up until 2026:

If you have credit card points that you’d like to sell then get in touch with us today!

Here are the most common questions we get from customers before they decide to sell their hotel or credit card reward points for cash online:

Is it actually legal to sell my miles?

Yes. There are no federal or state laws in the U.S. (with a minor, rarely enforced exception in Utah) that prohibit an individual from selling their own earned miles.

However, it is a violation of the airline’s Terms and Conditions. This is why you don’t see miles listed on eBay. Airlines want you to redeem points for low-value items like toasters or overpriced magazines. We help you bypass those restrictions by matching your miles with our corporate clients who need high-end travel.

How does the process work?

It’s faster than a TSA PreCheck line.

💰 Rates, Numbers, and Estimates

How much cash will I actually get?

Market rates fluctuate based on demand, but generally, you can expect between 0.8 cents and 1.8 cents per mile. Higher demand programs (like Amex or Chase) command the highest premiums.

Specific Examples:

To calculate your estimated payout, use the formula:

Is there a minimum amount?

Typically, we look for accounts with at least 50,000 miles. For premium credit card points (Amex, Chase, Citi), we can sometimes work with balances as low as 25,000.

🔒 Security and Risks

Will the airline shut down my account?

While it is a risk because it violates their T&Cs, it is statistically very low when you work with a professional broker. We use secure, proprietary methods to book travel that looks like “gifted” flights for family or colleagues, which is a standard feature of most loyalty programs.

Pro-Tip: Never post your frequent flyer number or screenshots of your account on public forums like Reddit or Facebook. Airlines have “audit teams” that scan for these.

What information do I need to provide?

To verify your balance and ensure the miles are “clean” (not expiring in the next 15 days), we usually require:

Note: We recommend changing your password to a temporary one before sharing it with us, and then changing it back once the transaction is finalized.

✈️ Popular Programs for 2026

| Program | Demand Level | Estimated Rate |

| Amex Membership Rewards | 🔥 High | $1.3 – 1.7 \text{ cents}$ |

| Chase Ultimate Rewards | 🔥 High | $1.2 – 1.6 \text{ cents}$ |

| Delta SkyMiles | ✅ Steady | $1.0 – 1.2 \text{ cents}$ |

| United MileagePlus | ✅ Steady | $1.1 – 1.4 \text{ cents}$ |

| British Airways Avios | 📈 Rising | $0.8 – 1.1 \text{ cents}$ |

Why shouldn’t I just use the miles for a flight?

If you can find a Business Class seat to Europe for 60,000 miles, you should take it. That is the best value. But in 2026, with “dynamic pricing” and limited “Saver” awards, many travelers find that a flight costs 400,000 miles. At that point, the “cash value” of those miles is significantly higher than the flight itself.